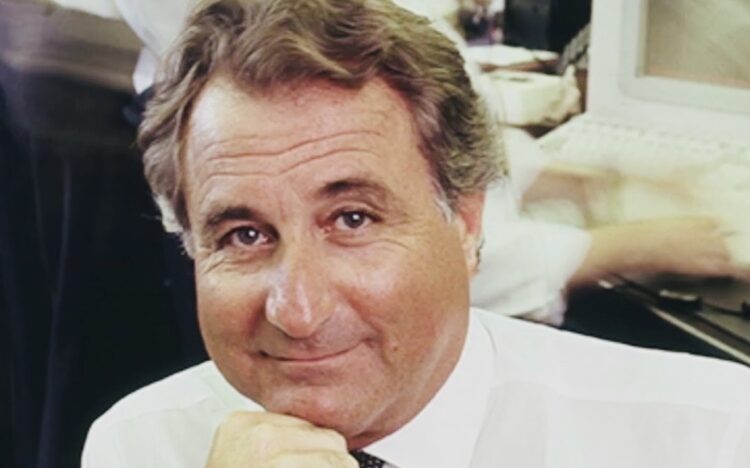

Bernard (Bernie) Madoff was the ultimate fraudster, a revered Wall Street trader and investment advisor who bilked his clients to the tune of $64 billion. Madoff’s epic Ponzi scheme, which went bust during the great financial crisis of 2008, is the subject of Joe Berlinger’s fascinating four-part Netflix series, Madoff: The Monster of Wall Street.

Madoff’s victims ran the gamut from the ultra-wealthy to the ordinary middle-class saver who could not resist the allure of consistently high interest rate returns on their investments. They included the novelist Elie Wiesel and the Hollywood director Steven Spielberg.

Berlinger’s partially dramatized documentary, a parable of greed and betrayed trust, charts the rise and fall of a complicated and exceedingly unscrupulous man who could be a bully, yet also a caring and kind individual.

At the end of the day, though, Madoff was a heartless swindler who played fast and loose with people’s hard-earned funds. When FBI agents raided his offices in Manhattan fourteen years ago, they found a giant-sized screw on his desk, an ornament that symbolized his utter contempt for his fellow human beings.

A widely respected Wall Street fixture before his precipitous downfall, he was the son of Jewish immigrants from Russia and Poland. Determined to be successful, he started an investment business in 1960 dealing with over-the-counter stocks. On the side, he managed clients’ savings.

The stock market crash of 1987 almost ruined him, but thanks to a $30,000 loan from his father-in-law, he weathered the storm, eliciting the admiration of grateful investors who basked in the glow of 11 percent to 15 percent returns.

By that point in his career, he had about 5,000 clients and was rich beyond his wildest dreams. He and his wife, Ruth, were the owners of a yacht, a luxury condo in New York City, and several vacation homes in the United States and Europe.

During the 1990s, he began creating fake paper trails, prompting a federal oversight agency, the Securities Exchange Commission, to investigate his less than honest dealings. Emerging from that probe with a clean bill of health, he felt supremely emboldened. At one juncture, he was even turning away prospective clients clamoring to board his train.

Working in tandem with his two sons, Mark and Andrew, and his brother, Peter, Madoff operated two separate businesses that functioned entirely independently. His shady investment advisory company was situated on the seventeenth floor of a skyscraper, while his legitimate trading firm was on the nineteenth floor.

A controlling man, Madoff did not provide clients with electronic access to their accounts. And he discouraged questions from investors. Yet they trusted him implicitly, assuming he was a person of integrity.

However, Goldman Sachs and Salomon Brothers, two of the leading brokerage houses on Wall Street, were suspicious of Madoff’s stagecraft and refused to do business with him. Wall Street insiders like Harry Markapolous informed the Securities Exchange Commission that he was a scammer, but his warning was ignored. The Securities Exchange Commission finally audited him in 2005, but he managed to dodge the bullet.

The financial meltdown of 2008 was Madoff’s undoing. With stocks tumbling at a dizzying pace, investors hastily withdrew funds from Madoff’s portfolios valued at $1.5 billion, but he had only $300 million to cover the outflow. “I knew the game was over,” says Madoff, referring to the gradual collapse of his Ponzi scheme.

In December 2008, he finally fessed up, confessing to his family that his business was built on a foundation of fraud. Ruth Madoff, an astute woman and a bookkeeper, implausibly claims she was clueless.

Unwilling to be accessories to their father’s crime, Mark and Andrew Madoff turned him in to the FBI. He confessed, becoming the ugly face of the American financial crisis.

To protect his family, he admitted total guilt. But in the meantime, individual investors had lost $19 billion. Madoff ruined the lives of countless Jewish investors, who never imagined that a Jew would defraud them.

Madoff and several of his associates, including his brother, were arrested, but JP Morgan Chase, a major Wall Street company that had profited handsomely from Madoff’s machinations, got off relatively lightly with a hefty fine.

Irving Picard, a lawyer who had been appointed as a trustee to claw back Madoff’s ill-gotten gains, compelled his top three investors to return more than $1 billion. Picard enriched himself fabulously in the process, billing the federal government $1 billion in legal fees.

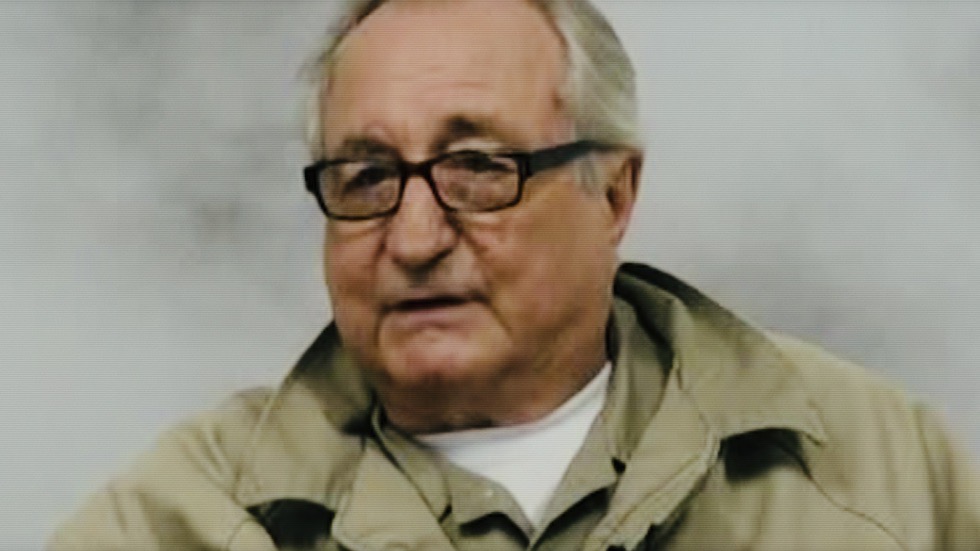

Madoff, having been sentenced to 150 years in prison, died behind bars in 2021 at the age of 82. Regrettably, the documentary omits his years in jail.

Mark Madoff, 46, committed suicide. Andrew Madoff, 48, died of cancer. Madoff’s wife’s was left homeless, at least for a while, after the government seized her properties.

The Madoff debacle left a trail of destruction and bitterness in its wake and will be remembered for a long time to come. It exposed the Securities Exchange Commission as an inept organization. It proved that supposedly reputable brokerage companies cannot be fully trusted to protect the assets of their clients. And it showed that the claims of even the best financial gurus must be verified.