According to James Wolfensohn, the former president of the World Bank, he was the greatest banker of his generation.

Edmond J. Safra, the object of his admiration, was the founder and chief executive officer of the Republic National Bank of New York, the Banco Safra in Brazil, the Trade Development Bank in Geneva, and Safra Republic Holdings in Luxembourg.

Involved in a variety of commercial activities ranging from real estate to shipping, he ventured into new territory when he helped finance a film by the swashbuckling Hollywood actor Errol Flynn. Never completed, this misbegotten project was one of his very few failures and spelled finis to his adventure in cinema.

A Sephardic Jew whose family was forced out of Syria and then Lebanon, he presided over a multibillion-dollar business, with 7,000 employees on four continents, toward the end of his storied 52-year career.

An avatar of globalization long before the term was incorporated into the lingua franca, he was fluent in six languages and lived in Lebanon, Italy, Switzerland, France, Brazil, Monaco, Britain and the United States.

Daniel Gross, an American journalist specializing in economics, has written a sweeping biography of Safra. Commissioned by his wife, Lily, A Banker’s Journey: How Edmond J. Safra Built A Global Financial Empire (Radius Book Group) is a portrait of a man who, as Gross observes, could “connect the dots.”

Describing him as “a globe-trotting billionaire” and “a child of Aleppo’s Jewish quarter and Beirut’s Wadi Abu Jamil neighborhood,” Safra was born in Aley — a summer resort near the Lebanese capital — in 1932, a dozen years after his father, Jacob, a financier, left Aleppo. The third largest city in the Ottoman Empire and a major metropolis in independent Syria, Aleppo was a hub of trade and commerce in the Middle East.

Jewish entrepreneurs like Jacob Safra prospered by supplying loans and letters of credit and trading in gold. (In Arabic, Safra means yellow or gold). But after an upsurge of sectarian violence in Aleppo, he decided it was no longer safe and moved to Beirut, where he remained for 32 years.

Edmond, one of his sons, had a deep sense of belonging to Lebanon’s diverse religious and ethnic culture. But even Lebanon could not offer its Jewish citizens a guarantee of safety. The Vichy colonial regime in 1940 imposed restrictions on Jews. And in 1945, a dozen Jews were murdered in a pogrom in Tripoli. Nevertheless, 6,000 Syrian Jews fled to Lebanon after Syria declared independence in 1946.

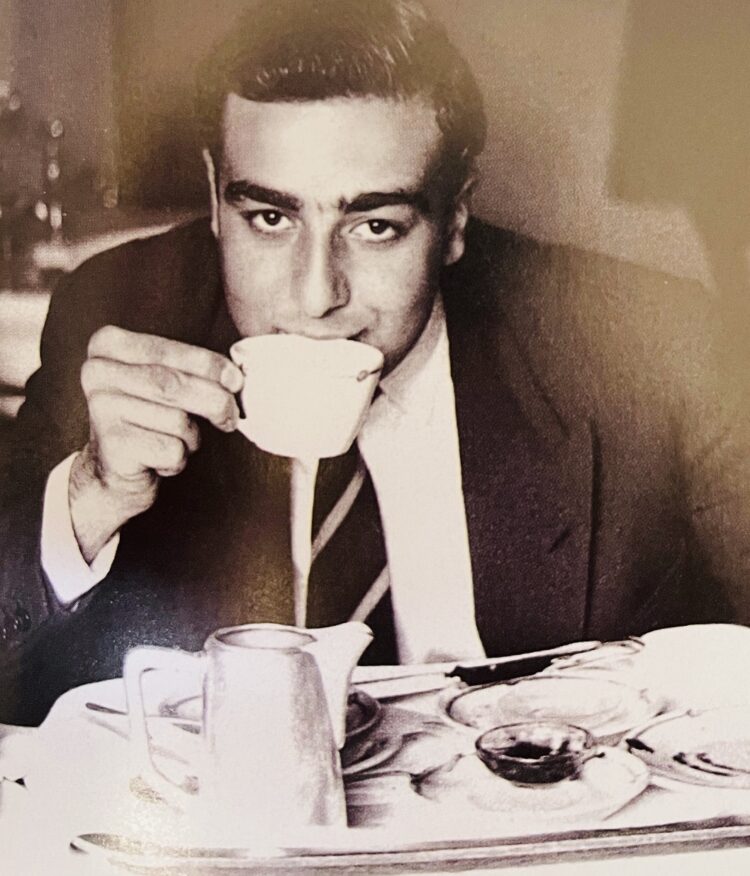

A year later, as tensions flared in Palestine, Jacob entrusted Edmond, his second son and a business prodigy, to set up a gold trading and foreign exchange operation in the Italian city of Milan, a center of jewelry production. He flew to Europe by way of Lod airport, near Tel Aviv.

In Milan, Safra turned to what Gross calls “the Aleppo diaspora” in Britain, France and Canada to attract capital.

Safra’s entire family joined him in Milan in 1952, shortly after the Safras’ apartment in Beirut was ransacked. Hedging his bets, Safra’s father left Banque Jacob E. Safra, the family enterprise, in the hands of local managers.

Having expanded into São Paulo and Geneva, Safra cast an eye at the United States, which, as Gross explains, “offered protection from the sectarian violence in Beirut” and the “inflation and political instability that wreaked havoc” in Brazil. It was a wise move. The Republic National Bank he established in Manhattan grew into the eleventh largest bank in the United States, yielding its investors an astounding annual return of 23 percent at one point.

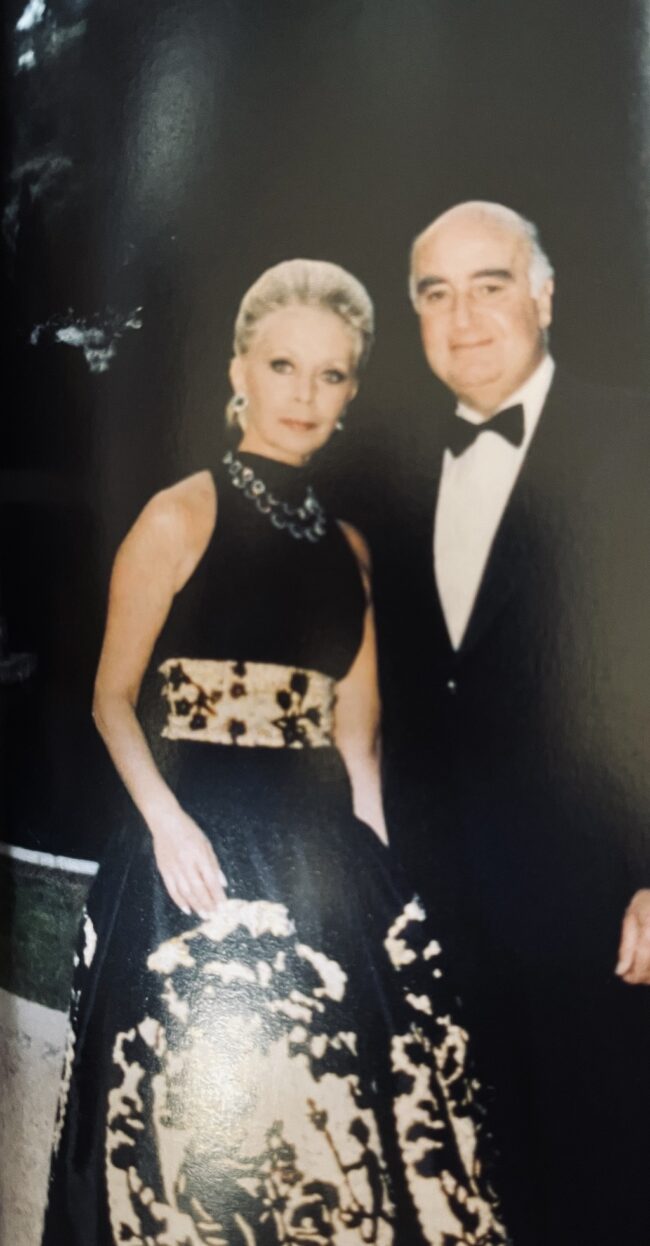

A bachelor until the age of 43, Safra got married after meeting Lily Monteverde, a divorcee of Ashkenazic descent with three children whose former husband had been an important client of the Safra banks. “He needed someone he knew wasn’t only after his money, someone who could hold her own with him, and someone who was his social and intellectual equal,” says Gross.

Throughout his life, Safra engaged in philanthropy. He financed efforts to create community institutions for Sephardic Jews in Brazil, Switzerland and the United States. He endowed the first chair in Sephardic Jewish history at Harvard University. He sent funds to Jews unable to leave Aleppo and Damascus. And he played a behind-the-scenes role in Syria’s decision to allow Jews to emigrate and in the transfer of Torah scrolls from Syria and Lebanon following the dissolution of Jewish communities there.

Concerned about the sensitivities of his Muslim clients, Safra avoided doing business explicitly in Israel until the early 1970s. He travelled to Israel for the first time in 1974 for the opening of a yeshiva in Jerusalem named after his father. He soon began to invest in initiatives aimed at improving the socio-economic status of Sephardic Jews in Israel.

By the 1990s, Parkinson’s disease had virtually incapacitated him, reducing him to mood swings, emotional outbursts and episodes of feeling “off.” By then, he could no longer “indulge his habit of having pastries and pistachios sent from Beirut to Geneva or New York,” says Gross.

As he grew sicker, he sold Republic and Safra Republic Holdings to the Hong Kong and Shanghai Banking Corporation for $10 billion, the highest amount of cash ever paid for a bank in the United States.

Safra died under tragic circumstances in Monaco on December 3, 1999.

In summarizing his legacy, Gross writes, “Edmond Safra (was) a founder (and) a creator who shaped history and influenced thousands of lives by building banks with an unrivalled record of success. One would be hard-pressed to think of a more successful banker in the second half of the twentieth century.”

Gross, in A Banker’s Journey, has written a comprehensive and readable account of an extraordinary person. But on occasion, it reads like a glorified puff piece. His book would have been better had he adopted a more balanced approach.